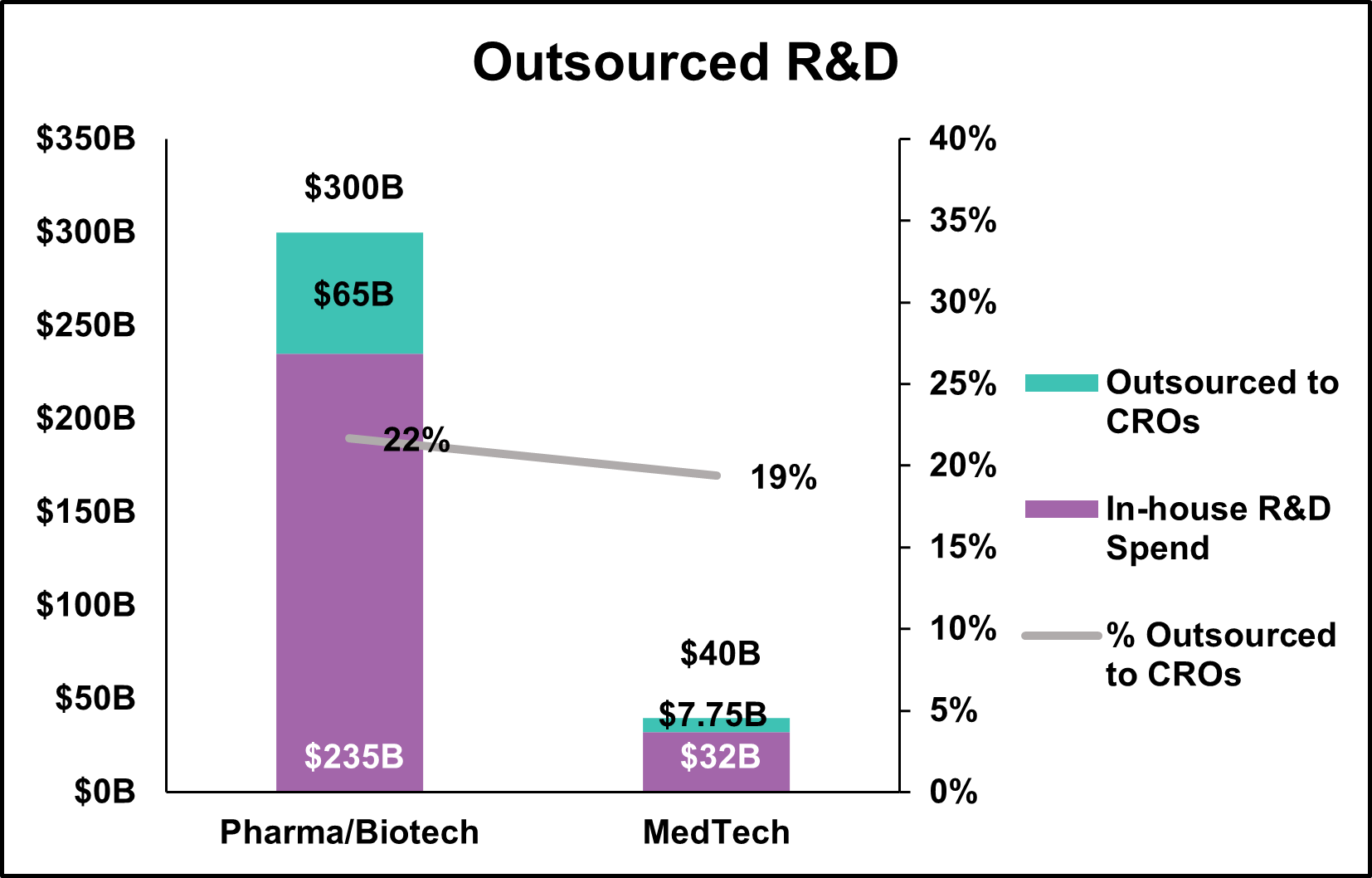

The MedTech industry continues to thrive and innovate. According to Markets and Market’s “The Global MedTech Industry Outlook 2024” report, the MedTech market is expected to grow 4% in 2024 to $668.2B. Transformative technologies such as artificial intelligence, robotics, and in vitro diagnostics are expected to drive growth over the next decade. Per Ernst & Young, in 2023, 433 publicly traded MedTech companies combined to spend $34.4B (approximately 6%) on research and development (R&D). Applying 6% to $668.2B would result in $40B R&D spend by MedTech companies in 2024.

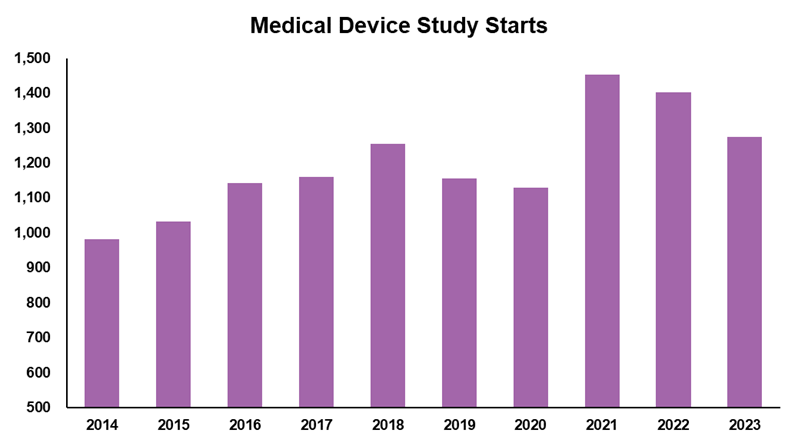

The number of industry-funded, interventional medical device study starts were up almost 40% (400 studies per year) prior to an industry-wide slowdown in 2023. With that level of spend and activity, how come the MedTech industry does not have many choices when it comes to MedTech advisory and clinical development partners?

The CRO Industry

The clinical research organization (CRO) has always catered to the pharmaceutical/biotechnology sector due to the sheer volume of work. Statista.com reports the global pharmaceutical industry spent more than $300B on R&D in 2023 (or 7.5x the estimated amount for MedTech). Medpace, a large biotech-focused CRO reported in a June 2024 presentation that the addressable Phase I-IV clinical development market was approximately $125B, with $65B of that spend outsourced to CROs. Working backward, we can infer that approximately 22% ($65B/$300B) of pharmaceutical/biotechnology R&D is outsourced to CROs. Grandview Research estimates the medical device CRO market is approximately $7.75B, which would infer that 19% of MedTech R&D is outsourced ($7.75B/$40B) to CROs.

Often, MedTech companies find themselves in the position of having to choose between a large pharmaceutically focused CRO or a small MedTech CRO without the expertise or scale to adequately support their projects. The four largest publicly traded CROs (IQVIA, Fortrea, ICON, and Medpace) offering MedTech services have almost $64B of backlog. Keep in mind MedTech only outsources $7.75B annually. Combined clinical work outsourced by pharmaceutical, biotechnology, and MedTech companies is estimated to be $72.75B of which 11% comes from MedTech companies. While the large CROs are great companies, the majority of their revenue and focus is with pharmaceutical/biotechnology companies. Overall, MedTech likely makes up less than 10% of their entire backlog. 99% of all MedTech companies would not move the needle from a backlog perspective at any of the large pharmaceutical CROs.

Avania’s ownership group identified this MedTech CRO mismatch and have been diligently filling the void by building Avania into the leading MedTech advisory and clinical development partner.

Vision

The first step in the process was defining the market. MedTech means a lot of different things to different parties. Avania views MedTech as a multifaceted market made up of three verticals: Medical Device, Diagnostics/IVD, and Digital Health (imaging is included under the Digital Health umbrella).

Next was understanding MedTech sponsor needs and creating a clear service offering with a flexible operating model designed to satisfy sponsors ranging from start-up to large multibillion dollar OEMs. Avania landed on two primary service offerings: 1) Advisory and 2) Clinical Development. Each “service line” has subspecialty capabilities designed to assist sponsors with everything from a one-off consultative request to running a large global pivotal study. Avania is uniquely positioned to assist sponsors across the entire life cycle from product design through commercialization: a MedTech partner that truly offers “one-stop shopping” for its clients.

Avania’s Advisory services offering provides industry expert advice in the areas of:

- Product Design & Development

- Market Access & Reimbursement (which includes a patient hotline service)

- Regulatory (both engineering and regulatory approval)

Avania’s Clinical Development offering functions like a traditional CRO with the exception that MedTech is the sole focus. Avania is not a pharmaceutical CRO masquerading as a MedTech CRO — all of its employees, processes, and procedures are designed to support MedTech studies.

Strategy

Once the market and company vision were defined, it was time to execute. Avania embarked on a purposeful, thoughtful, and aggressive acquisition strategy. To date, Avania has completed nine acquisitions, all MedTech focused and complementary to both its service offerings and therapeutic expertise.

Factory CRO — The original acquisition that commenced the journey. Factory provided the initial platform from which Avania was built. Additionally, Factory provided a foothold in Europe, along with multitherapeutic expertise with a strength in orthopedics. Medical reimbursement along with in vitro diagnostic capabilities set the stage for future growth areas.

Milestone Research Organization — U.S.-based niche provider with medical reimbursement, patient hotline capabilities (new service offering), and orthopedic expertise (further strengthening an already strong area).

Five Corners Medical Device Consultants — Australian-based full service MedTech CRO. Key therapeutic areas were urology and ophthalmology. Strategically provided Avania with market leading first-in-human (FIH) trial expertise and presence in the important Australian market providing favorable research tax benefits for MedTech sponsors.

Boston Biomedical Associates (BBA) — Avania’s first sizable U.S. acquisition of a full service MedTech CRO. BBA provided strategic regulatory consulting capabilities and cardiovascular, neuro, endocrine, and orthopedic therapeutic expertise.

IMARC — U.S.-based full service MedTech CRO with strong cardiovascular, neuro, and orthopedics expertise. IMARC also brought a very strong quality function to the group.

MAXIS — A global MedTech CRO that expanded Avania’s presence in the U.S. and Europe. MAXIS was a well-respected advisor to emerging MedTech companies with a “roll up its sleeves” attitude. Avania’s cardiovascular and neuro capabilities were strengthened and a variety of other therapeutic areas were added. Avania’s customers benefitted from an expanded roster of subject matter experts in the global pre-clinical, clinical (in vitro diagnostics, artificial intelligence/machine learning, and Software as Medical Device), and regulatory/engineering functions.

Hull Associates, LLC — One of two acquisitions made the same day focused on adding a niche advisory firm providing Market Access and Market Reimbursement capabilities. Hull Associates is a recognized leader in assisting MedTech companies of all sizes navigate the market access and reimbursement pathways.

Ironstone Product Development (IPD) — Acquired the same day as Hull Associates, IPD brought product design and development capabilities to Avania. IPD’s core focus areas are early product development, quality, and strategic regulatory with projects in the areas of medical robotics and surgical navigation, AI/machine learning, imaging, respiratory devices, IVDs, and wearables.

Anagram — Avania’s most recent acquisition expands its presence in Europe, specifically Spain. Anagram, a full service MedTech CRO, bolsters Avania’s cardiovascular, neuro, and oncology expertise and provides a core lab to expand its service capabilities.

Smart acquisitions alone do not make a great business; weaving these companies into an integrated comprehensive global MedTech partner provides a seamless customer experience.

Integration & Culture

Avania’s global Clinical Development service line maintains its high quality with standardized global SOPs resulting in the reliability and consistency expected by MedTech sponsors. A project managed out of Europe has the same SOPs as one run out of Australia. Avania is truly a global business not a patchwork of disparate businesses pretending to be an integrated global business. Our quality organization has a seat at the table and ensures quality is taken into consideration every step of the way.

Avania’s size (roughly 300 employees) makes it the perfect partner for large MedTech OEMs or start-up organizations. Our entrepreneurial, solutions-oriented culture encourages a “solutions-based” mindset of solving problems for our customers. Employees are our greatest asset — their passion and dedication make a difference every day. Avania employees understand customers come to us because they have an issue to be resolved, a question that needs an answer, and require a partner they can trust. Employees are encouraged to create novel solutions and are supported along the way. We have the best in the business and are proud of our accomplishments.

The Future

AdvaMed reports on its website there are more than 6,500 MedTech companies in the United States alone. Artificial intelligence is changing the game and will be a major disruptor for years to come. The diagram below demonstrates our capabilities and provides a road map for remaining a relevant MedTech partner.

We plan to invest and expand our capabilities in a variety of ways:

- Therapeutic expertise — Therapeutic subject matter experts (SMEs) provide the scientific and operational knowledge necessary to help sponsors design and execute clinical trials. For example, we will be growing our bench of SMEs in cardiovascular, the largest MedTech therapeutic area.

- Advisory technical expertise — Regulations are never static and evolve as new technologies and clinical trial strategies emerge. Successful navigation of market access and reimbursement are also critical pathways toward achieving commercialization.

- Site relationships — Clinical trials require patients and vast majority of patients come through investigator referrals. Strengthening existing site relationships while forging new ones will help patient and investigator recruitment.

- Technology — AI is not only influencing MedTech, it is also impacting how clinical trials are executed. AI is expected to drive efficiencies saving sponsors time and money while also improving quality.

- Employees — Employees are Avania’s biggest and most important investment. Continuing to retain, train, and recruit talented team members is essential.

Avania will evolve, invest, and pivot with the industry so it can achieve its mission of partnering with MedTech sponsors to bring life-changing technology to market, resulting in improved healthcare outcomes.