In the book “ Why Medicare Advantage Plans are Bad,” the author, David W. Bynon, defines Medicare Advantage Plans as a type of health insurance plan that provides health insurance via private insurance companies for people above 65 and those with disabilities. A common alternative to Original Medicare, the United States federal government’s traditional health coverage, Medicare Advantage, combines Original Medicare coverage while offering some additional benefits.

The core of David’s argument throughout the book addresses some common misconceptions people have about Medicare Advantage. He states that many believe it to be an attractive alternative to Original Medicare with zero up-front costs and additional benefits like dental and vision coverage and prescription drug coverage. However, the fact is that millions of Americans insured under this particular plan end up paying more money than they would with traditional Medicare, all while receiving no additional benefits.

David compares the two plans in detail and clearly explains the downsides of Medicare Advantage plans and why they are not a good fit for everyone. Doing so, he does not fail to underscore some of the benefits of Medicare Advantage plans. The book digs deep into the misunderstandings people have about the benefits Medicare Advantage plan may offer and addresses them head-on to help readers make an informed decision about their health. Let’s learn more!

What is Medicare?

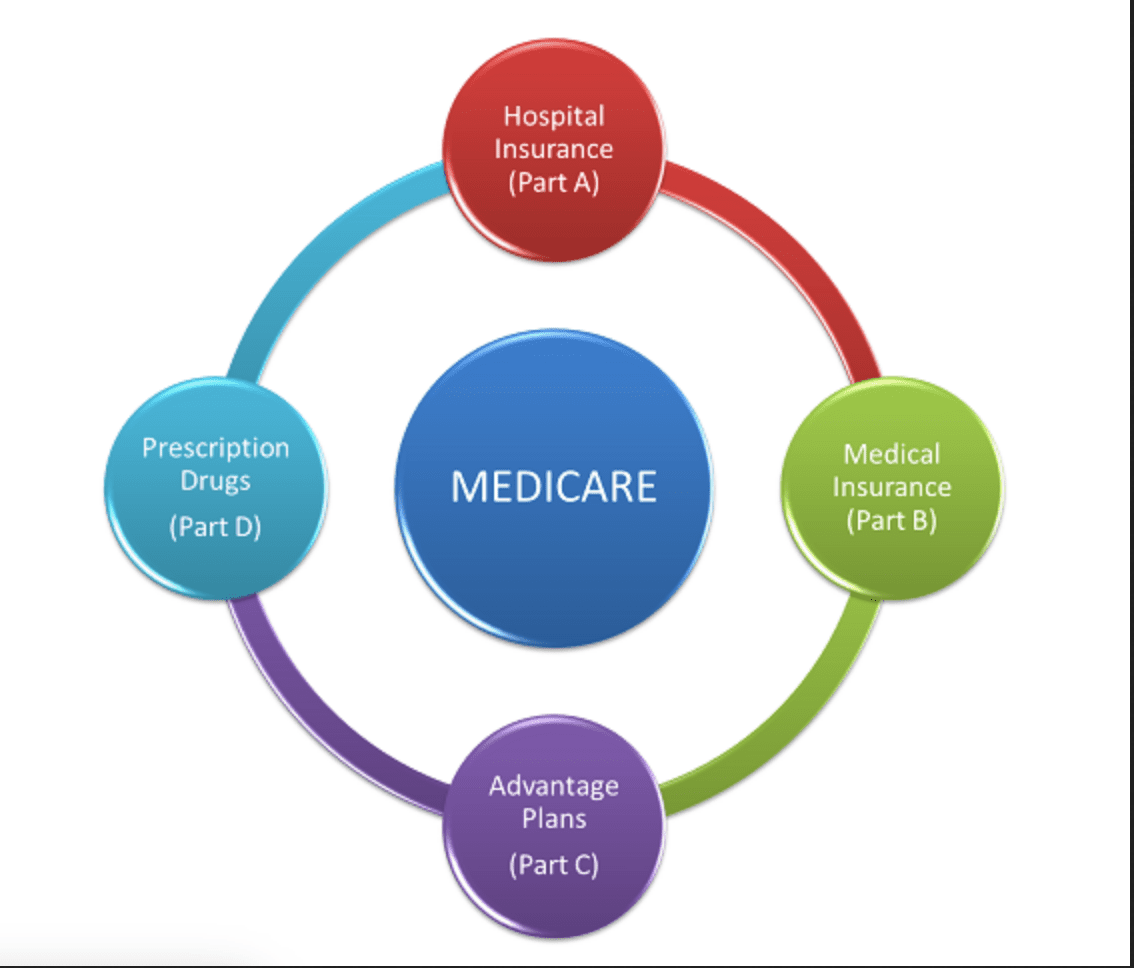

In his mission to make Medicare easier for people to comprehend, David states that Medicare insurance is divided into three parts:

Medicare Part A covers inpatient hospital care and care in skilled nursing facilities.

Medicare Part B covers 80% of doctor visits, lab tests, diagnostics, ambulance services, etc.

Medicare Part C is an optional health plan option that replaces Original Medicare’s Part A and Part B coverage while adding extra benefits. Also known as Medicare Advantage, its most common additional benefits include prescription drug coverage.

Medicare Advantage vs Original Medicare

The author contends that understanding the fundamental differences between both plans is central to making the right choice for your health and finances. The book goes into great detail to explain who Medicare Advantage plans benefit and who they may not suit best. To begin with, David explains that one of the key differences between Original Medicare and Medicare Advantage is when people pay. With Original Medicare, most costs are paid in advance. He says that makes it easier to budget and manage healthcare in retirement. In contrast, with Medicare Advantage, you have to pay medical costs when using a healthcare service, making it difficult to set a budget for healthcare costs.

He proceeds to demonstrate how Medicare Advantage is not the best option for some people. While it offers all the services one would receive under Original Medicare, those with chronic health conditions should not join Medicare Advantage if they do not have Medicaid or receive retiree benefits to pay monthly premiums and out-of-pocket costs.

That is because Medicare Advantage will likely cost them more because of the ongoing care needs for a chronic illness like Diabetes. Treatments for potential complications like heart and kidney diseases, skin conditions, and eye damage will come with copayments. Lab tests, diagnostics, ambulance services, and inpatient care can blow your budget.

David states another prominent reason why a Medicare Advantage can be a double-edged sword. He points out that Medicare Advantage plans are not free as they claim to be. While they may be advertised as a $ 0 monthly premium and seem like an attractive offer, beneficiaries are likely to pay about 20% of out-of-pocket costs for coverage, including coinsurance/copayments, Part B monthly premium, and other deductibles. With Original Medicare, you can limit these costs with supplemental insurance or Medigap.

He asserts that Medicare Advantage beneficiaries with chronic health conditions are likely to pay more hospitalization costs for a short hospital stay than traditional Medicare. Furthermore, the book highlights that some Medicare Advantage plans use provider networks and members need to get referrals from their primary care doctors to see a specialist. That is a major downside for those who need regular care.

Some Benefits of Medicare Advantage

The author reiterates that one of the most significant advantages of Medicare Advantage is it provides additional benefits that Original Medicare coverage does not. These include routine dental and vision coverage, prescription drug coverage, in-home support, and more.

Besides, another advantage of Medicare Advantage over Original Medicare is that Medicare Advantage plans have a maximum out-of-pocket limit (MOOP) that protects you from excessive

healthcare costs relating to copays and coinsurance. But again, you can cover these costs with a Medigap under Original Medicare.

With that said, David is quick to point out that Medicare Advantage is only a good deal if:

- You are an exceptionally healthy individual without chronic health conditions, rarely needing healthcare services besides your annual wellness checkup.

- You qualify for Medicare Advantage Special Needs Plans (SNP’s)

- You have retirement or government benefits covering your premiums and copayments.

Medicare Advantage is not suitable for someone paying copayments out of pocket and suffers from a chronic health condition unless they have Medicare Advantage SNP’s to take care of their extra healthcare needs.

Having stated the benefits, the author finds it pertinent to mention that he has no personal bias against Medicare Advantage.

David W. Byon, in this book, provides a concise, transparent view of the US federal government’s health insurance by stating the pros and cons of each Medicare option available. While most information about Medicare out there is convoluted and long-winded, the author does a fantastic job in providing a wealth of details in a comprehensible way, making it simple for his readers to understand the ins and outs of Medicare plans.

That means when the time comes for you to choose your healthcare options, you will feel nothing short of comfortable and confident in making an informed decision about your health insurance needs.

Do you evidently need help with writing reviews? Feel free to visit this site to have your book review written by real experts from WriteMyPaperHub book report writing service.