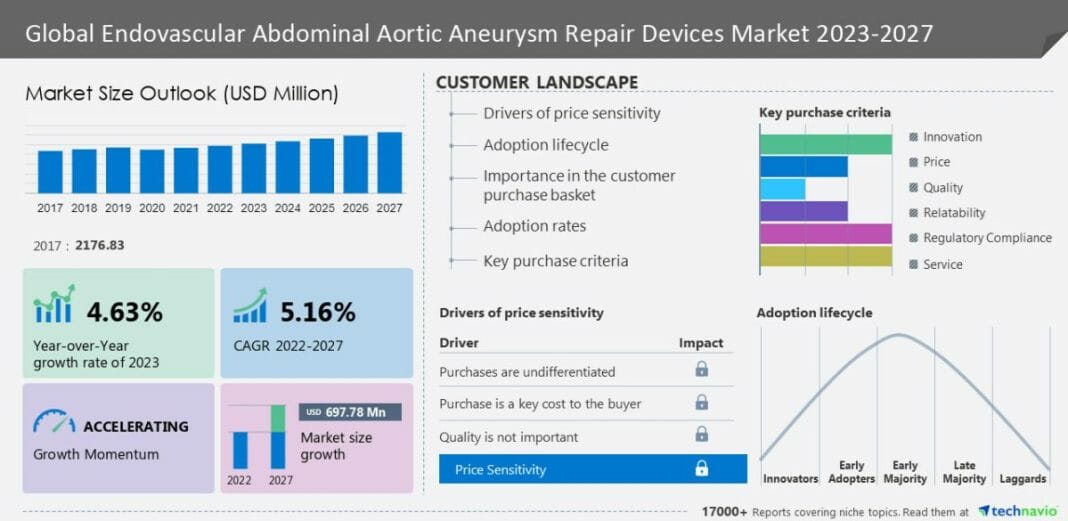

The endovascular abdominal aortic aneurysm repair devices market size is expected to grow by USD 697.78 million from 2022 to 2027. In addition, the momentum of the market will progress at a CAGR of 5.16% during the forecast period, according to Technavio Research.

The market is segmented by End-user (Hospital, ASCs, and Others), Product (Stent graft and Synthetic fabric graft), and Geography (North America, Europe, Asia, and Rest of World (ROW)). North America will contribute 46% to the growth of the global market during the forecast period. In North America, the need for minimally invasive endovascular devices to treat abdominal aortic aneurysms is increasing with the aging population. To facilitate the adoption of endovascular abdominal aortic aneurysm Repair Devices techniques. Furthermore, there has also been an increasing focus on clinical guidelines and payment rules. Hence, such factors boost the regional market growth during the forecast period. This report offers an up-to-date analysis of the current market scenario, the latest trends and drivers, and the overall market environment. Read Free PDF Sample Report.

Company Profile:

Braile Biomedica, Cardinal Health Inc., Cook Group Inc., Edwards Lifesciences Corp., Endologix LLC, Koninklijke Philips N.V., LeMaitre Vascular Inc., Lifetech Scientific Corp, Medtronic Plc, MicroPort Scientific Corp., Terumo Corp., W. L. Gore and Associates Inc., Artivion Inc., Lombard Medical Ltd.

Braile Biomedica – The company offers endovascular abdominal aortic aneurysm repair devices through its subsidiary Jotec.

- To gain access to more vendor profiles available with Technavio, buy the report!

Endovascular Abdominal Aortic Aneurysm Repair Devices Market: Segmentation Analysis

By Segment – The hospital segment will be significant during the forecast period. Hospitals with state-of-the-art healthcare infrastructure and qualified medical staff, are able to successfully complete these complex treatments. Furthermore, they are more likely to accept patients for endovascular abdominal aortic aneurysm repair due to increased awareness among patients and healthcare professionals about its benefits. Hence, such factors drive the hospital segment during the forecast period. Learn about the contribution of each segment summarized in concise infographics and thorough descriptions. View Free PDF Sample Report

“Besides analyzing the current market scenario, our report examines historic data from 2017 to 2021”- Technavio

Endovascular Abdominal Aortic Aneurysm Repair Devices Market: Driver & Trend:

Driver

- Aging population and rising prevalence of abdominal aortic aneurysms

- Advancements in endovascular technologies

- Growing awareness among healthcare professionals and patients

The aging population and rising prevalence of abdominal aortic aneurysms drive the market growth. There is a rise in the risk of developing abdominal aortic aneurysms due to age-related blood vessel changes. Furthermore, factors like endovascular repair devices offer effective treatment alternatives to address this issue. Consequently, with considerable emphasis on healthcare infrastructure, nations such as Asia and Latin America are experiencing an increase in the occurrence of abdominal aortic aneurysms. Hence, such factors drive the growth of the market during the forecast period.

Strategic alliances among market vendors are a key trend in the abdominal aortic aneurysm repair devices market. Identify key trends, drivers, and challenges in the market. Download free sample report to gain access to this information.

Related Reports:

The aneurysm coiling and embolization devices market share is expected to increase by USD 1.87 billion from 2021 to 2026, and the market’s growth momentum will accelerate at a CAGR of 9.06%.

The global flow diversion aneurysm treatment market size is estimated to grow by USD 2,107.08 million at a CAGR of 8.8% between 2022 and 2027.

What are the key data covered in this endovascular abdominal aortic aneurysm repair devices market report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the growth of the endovascular abdominal aortic aneurysm repair devices market between 2022 and 2027.

- Precise estimation of the endovascular abdominal aortic aneurysm repair devices market size and its contribution to the market in focus on the parent market

- Accurate predictions about upcoming trends and changes in consumer behavior

- Growth of the endovascular abdominal aortic aneurysm repair devices industry across North America, Europe, Asia, and ROW

- A thorough analysis of the market’s competitive landscape and detailed information about vendors

- Comprehensive analysis of factors that will challenge the growth of endovascular abdominal aortic aneurysm repair devices market vendors.