Rapid Medical, a company focused on the development of responsive, adjustable neurovascular devices, announced today that it has completed an oversubscribed Series D financing of $50M.

The proceeds will be used to support the fast commercial growth of the company’s minimally invasive stroke products worldwide. The round was led by MicroPort with participation from CITIC private equity fund (CPE), Deep Insight and existing investors.

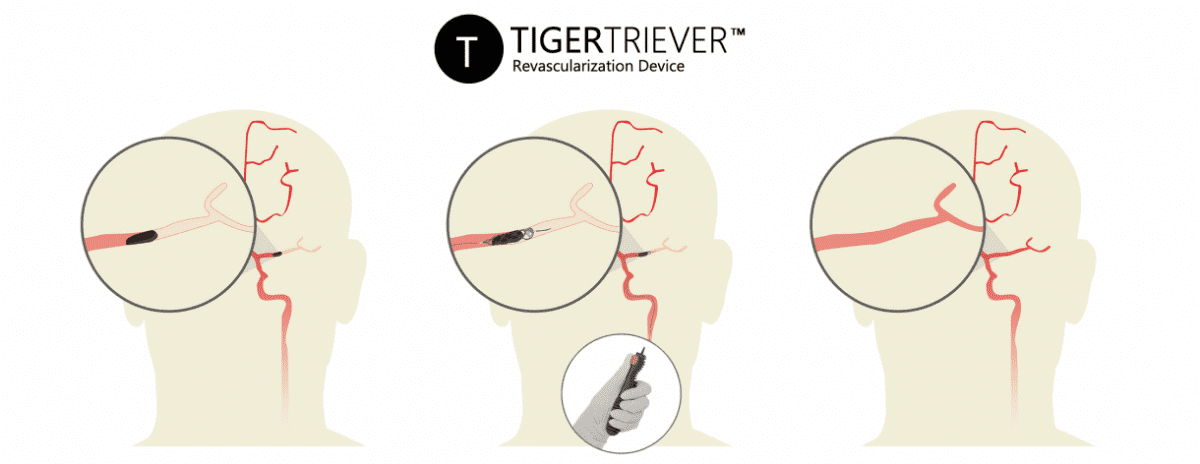

Rapid Medical recently announced the FDA clearance of its TIGERTRIEVER™ revascularization device for use in the treatment of ischemic stroke. TIGERTRIEVER is a new class of clot retriever. The device’s intelligent control enables neuro interventionalists to better remove blood clots and restore blood flow to the brain following an ischemic event—a condition that devastates 700,000 Americans annually. TIGERTRIEVER 13, the smallest device in the TIGERTRIEVER portfolio, is the only clot retriever in the world indicated for the removal clots from more distant areas in the brain. TIGERTRIEVER 13 is CE marked and not cleared by the FDA.

The proceeds will be used to expand commercial operations in US and Europe, create additional clinical evidence supporting the superiority of the company’s products, and advance the product development pipeline utilizing company’s proprietary braiding technology platform. In addition, the funding will be used to obtain regulatory approvals in new strategic territories such as China.

“We’ve revolutionized intravascular devices by providing physicians with the ability to remotely adjust devices to the anatomy. We are thrilled that this new round will allow us to expand this mission,” said Ronen Eckhouse, co-founder and CEO of Rapid Medical. “We are excited about the quality of new and existing investors joining this financing.”

As part of the financing round, Chen Chen, a principle at CPE, will join Rapid Medical’s board of directors.

Jefferies LLC served as exclusive placement agent for Rapid Medical in the financing.